- You are here:

- Home »

- Blog »

- Starting A Computer Repair Business »

- Pricing In Your Computer Business – Why Margin Matters

Pricing In Your Computer Business – Why Margin Matters

Author: Chris Michalec

How do you measure success in your computer business? Is it the number of customers you have? Maybe how much profit you make each month? Or maybe you go by the revenue you bring in. Properly defining success in your business is critical for sustainable growth and a very profitable business that will support more than just you. If you never grow out of a one person business, then you haven’t created a business; you have just created a job for yourself.

Another question that frequently comes up, whether you are just starting out or launching a new service, is how to price it. Obviously you want to look at what others in your area are charging, but this shouldn’t be the only way you determine what to charge. Let me give you the one way to measure success that will also help you competitively price your services every time and give your business room to grow – margin!

Having the right margin, also called profit margin, is the difference between success and failure in business. Let me give you a real world example. Right now, there are several different mobile phone manufacturers. The big players are Nokia, HTC, Samsung, & Apple, at least with smartphones. Apple has the largest share of profit by far, with Samsung coming in second. HTC sells a lot of phones, but isn’t making any money. Now, if you judged by revenue or number of customers, HTC might rank high. However, which business would you rather have? Apple or Samsung’s, right? HTC isn’t a profitable business right now, so who cares about their revenue or number of customers. You are in business to serve your customers, but also to make money!

Now, you might be saying that profit is the best way to judge. However, you probably have several services, and in terms of the dollar amount they provide, very different numbers. Your actual dollar profit isn’t always the best way to judge success. You want that to grow, but $5,000 profit working 80 hours versus $2,500 profit working 10 hours is a big difference. Your margin is higher on the $2,500 because you are working fewer hours, and therefore have lower costs. You don’t want to work yourself to death. All profit isn’t created equal.

When you are setting prices for something new, margin is a great way to figure out what you should be charging. For example, we have some of our cloud services that in actual dollars, don’t bring in as much profit as our managed services. However, our margins are very healthy on our cloud services so I know that I have priced them right. If I set my prices on pure dollars, I would price myself out of the market. Instead, I make good margins and plan to make up the rest on volume.

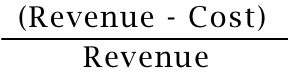

Calculating your margin isn’t difficult at all. All you have to do is take your revenue, whether it is on a customer, service, or your business as a whole, and subtract your costs. Then divide that by that same revenue number. Convert that to a percentage, and you now have your margin. For an example, let’s say that you sell a service at $150. Delivering this service costs you $50. You would have a 67% gross margin. Here is how the formula would work.

$150 – $50 = $100

$100 / $150 = .67

.67 x 100% = 67%

Knowing your gross margin (just the costs for delivering the service) and your net margin (all your costs included) is very important. When pricing your services, you want to focus on gross margin. But looking at your business as a whole, don’t forget net margin. Net margin will include rent, utilities, salaries, insurance, etc. Your gross margin is just going to include the actual costs of delivering that particular service or providing service to a specific customer. For example, for managed services, you would include your RMM tool costs and anything else, like antivirus software, that you include in your managed services plan.

In order to grow your business, you need sufficient margin. Otherwise, you won’t be able to afford advertising, to hire employees, or even to move to a bigger office. I like to keep my gross margin around 60%-70% for most of our services, with some having to be lower due to market prices. In our market, I have found that this keeps us nicely profitable, but still very competitive on deals. My margin also varies based on how complex it is for me to deliver the service.

When you are judging your business success, remember that not all growth is good growth. Margin matters; and, when you get it right, you’ll have plenty of cash in the bank with which to grow your business.

How are you measuring your success, and what margin do you aim for? Let me know in the comments.

Article was written by Chris Michalec:

Chris is the owner of Parkway Technology Solutions, a managed services provider serving small businesses with 1-15 employees in Winston-Salem, North Carolina. He started Parkway Tech in 2008 after 10 years of working for several computer repair shops as a technician and manager.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Great article Chris. Margin is key in every business, if you’re spending $100 to make $100, you won’t be in business long. The nice thing about starting a one person computer repair business is that, if you are smart, expenses should be low, and margin should be high, so profitability is easy if you can market well.

One little pet peeve of mine is this comment “If you never grow out of a one person business, then you haven’t created a business; you have just created a job for yourself.” I hear this a lot from different sources. First, technically it’s a business regardless of the number of employees, because money is being exchanged for a provided service, and second it makes it sound like once you have employees the owner doesn’t have a job anymore and the money just flows in. Which isn’t necessarily true. The owner still has a job that he created for himself, it’s just a different job. Every person has a different goals for their business, and some are happy working in their one man shop. For the record, my goal is to have many employees.

Andy,

I understand your point about the one person business. However, particularly in our line of work where clients depend on us for a quick response, they are very vulnerable to that one person getting burnt out, sick, or otherwise unavailable. Everyone has different goals, but not thinking long term about hiring and pricing those expenses in puts you in a tough position down the road.

Andy, if you haven’t already, I would highly recommend reading the book “The E-Myth Revisited” to get some more perspective on Chris’ statement about owning a business vs having a job. It will really change the way you think about your business.

Thanks Jamie, I haven’t read that book yet. I have heard a lot about it, and I will move it up my list of books to read. Like I said in my original comment though, I totally agree and want to build a business that runs without me, but there is no problem with starting as a one man shop, or always staying a one man shop is a person chooses to.

Chris, could you explain the best way of arriving at the cost of doing business? What factors should we take into account here?

For example, my business expenses average around $2,000 per month. How do I translate that into an hourly cost of doing business? Am I over complicating it or is it just a matter of dividing the costs by the number of hours I work?

Just trying to understand this a bit better. Thanks for the article.

I am also curious about this equation. How do I figure out what my margins should be at. When I first got started I thought any profit and good enough but as I am growing larger I am finding that I have to make so much money every month or I don’t have enough to pay my payroll.

Tommy,

You have your net margin and your gross margin. Your gross margin is just the direct cost of delivering your service, but does not include your overhead. So, for example, if you provide managed services, your gross margin would include expenses like your RMM costs for that client, your estimated labor costs for that client, and anything else you might bundle just for that client. You wouldn’t include rent, utilities, salaries, insurance, advertising, etc.

Your net margin is what you are talking about. It is always important to keep this in mind, but it can be tough when you are getting started since your net margin may be close to zero if you are just breaking even. To calculate that you will want your revenue, subtract all your costs (overhead and everything) from it and then divide that by your revenue. Convert that to a percentage, and you will have your net margin.

If you just want to know the margin on your hourly rate, just include your gas, a small amount for vehicle maintenance, and I like to use $20/hour for my labor costs. That is about what it would cost me to hire someone, so, while I want to make more than that myself, it makes it easy when you grow. Then you just use the formula to calculate your gross margin. Hope that helps!

Excellent article. I’ve slowly raised my margins on certain services and my older customers haven’t had any complaints. I Should have started higher but lesson learned.

That is the nature of supply and demand. They have a demand and you have a supply. Raise your margin too much and they seek help elsewhere. Keep it too low and you would not be making the gains you could be making. Older customers may not complain as long as they have faith in your services. Lose that added value and they lose trust and bolt on you.

Case in point, our family went to the same car mechanic for 20 years. I had three cars with them. The then manager did not charge what the book hours were but what the actual technician took to do the job. One of the newer tech’s spoke to the owner and this manager was ousted. This newer tech became the manager. Prices went up. We continued to take our cars there out of loyalty but over time lost trust. We did not feel we were getting the same service level as before and now the price was higher. I noticed I was taking my car to them more frequently for repairs. Taking it to other shops discovered they had used subpar parts and not dealer recommended parts. This caused me to have more repairs as those parts broke down more frequently.

I started the business at kind of a willy nilly margin and starting this year I have place a 40% margin on most of my goods. It has produced better profit and no loss of customers.

Good for you, Ron!

Great article, however I do disagree with one of your comments. “If you never grow out of a one person business, then you haven’t created a business; you have just created a job for yourself”. I really do not have any desire to grow out of a one person business, but it still is a business, and not just a job. I have just a job at a factory doing manual labor, I am tired of it and want to get out. It is going to take a while, but if I can build a computer business that makes an amount that equals what I make now I will be happy. At the rate that I charge, I figure that 20 hours a week of consistent business is all that I would need. I will then have time to do other things that I want to do.

Todd,

I understand you point, but I don’t feel a business you can’t sell is really a business. I have great respect for those who run things as a one person operation, but the only hope of selling would be selling your client list – not your business. In that case, you are your business. I’ve found Michael Gerber and others helpful in making sure I have a business that runs without me.

I have no desire to have employees after hearing of all the hassles, fees and laws that come into play when you start hiring people. My brother started a business and then started hiring people to make his business grow, but now he is back to only himself after finding out it took too much profit away from his business and he had to work harder for less.

David,

Having employees can be a hassle, but that is where having margins that allow for growth is critical. Also understanding the full cost of employees (benefits, taxes, insurance, training, etc.) is important. Employees cost a lot more than just their salary, but they are an essential part of making sure you have a business that can run without you.

A friend once told me that you need to start your day every single day with the key phrase “billable hours.” Don’t waste your time on anything but billable hours — It has saved me every time. If it isn’t going to make me a check … move on and don’t waste your time on it.

To add to what has been said….a basic understanding of accounting: Four types of accounts: Assets & Liabilities often referred to as balance sheet accounts then Revenues and Expenses often referred to as profit and loss accounts (there is another account beyond the scope of the article equity accts).

Expenses generally refer to the expenses to run the business. There is another term “overhead” which is non direct expenses in that it is to run the office such as rent, insurance, auto and fuel, answering service, office gal or employees not directly tied to revenue.

Then you have direct expenses which relate to a particular income such as a salesman or tech’s salary (or your own salary in a one man show). Most firms do not generally think of labor revenue in terms of gross margin but if that is all you sell then it is a good place to start. If I need to pay myself $400 per week to get myself from foreclosure, and I bring in $1200 per week in gross revenues not including sales of hardware or software then it could be said my labor has a gross margin of about 67% of each dollar.

I do not think most accountants would set up your books this way but if you do not sell much hardware or software or resell other peoples services this is a good guide to help you understand your income requirements and how much each hour actually contributes to your bottom line (the money you have left after paying minimal expenses).

Gost of goods sold is basically what you paid for the hard drive, margin is that figure compared to what you sold it for. Calculated the same way.

Why is any of this important? Well when we first start out or have little business we are tempted to undercut ourselves to get work. Knowing your true costs helps you to not work for free or loose money. Some jobs are best not done and let your competitor do.

How to set your price? A simple method. If you need $1000 per week for your own salary that works out to about $25 per hour wages. In services such as law, accounting and IT the gross billed consulting wage is at least 4x-5x the hourly cost. Since cost is $25 in our example you would not want to charge less than $100-125 per hour for normal retail out side consulting. This automatically takes in the cost of payroll taxes, insurance, proving you an office and minimal overhead.

To be technically perfect in accounting you need an accountant and one accountant will be different from another so there are few hard rules other than some of what I have outlined above.

Gross margin has nothing to do with expenses but it has to do with purchases a component of “cost of goods Sold”

On your tax return you put your gross sales on the first line, then the Cost of those sales on the 2nd line to deduct and come up with gross profit margin. Then from that is deducted all the overhead and operating expenses to get a net profit/loss.

If I buy a widget for $1 an sell it for 2 then I have a 50% profit margin or 100% markup. The two most common ways to describing it.

So a simple statement might look like this:

Sales harware/software $5000

Cost of sales -$3500

Gross profits from sales $1500

Service/Consulting income $5000

Expenses:

Rent $500

Elect $300

Insur $160

Supplies $80

Wages $4400

Total expenses $5440

Net profit $1060

This assumes your salary is within the $4400. Your purchases for the sales were $3500. In this case you have a profit even over your minimal monthly requirement.

Your profit margin is only 35% on hardware sales 1500/5000.

One could say that your margin on labor is even less as you cost $4400 per month labor and your labor revenue was only $5000.